In order to answer your request, we are obligated to process the data given above. Sometimes, however, we would like to use them for slightly different purposes, such as statistical data or informing you about our new products and services.We promise that we will use the given information for communication purposes only. We also remind you that you can unsubscribe from our mailing at any time (see Privacy Policy).

Selling goods and services isn't easy. When you add legal issues to just taking care of customer needs and product development, running an online business can prove to be a bit more difficult than you expected. VAT compliance is a challenging issue for every international e-commerce business in the European Union, especially in the case of combining a few different logistics models.

First of all, it is worth mentioning that since July 1, 2021, the rules of VAT taxation of B2C sales within the EU have changed significantly. In particular, the new legislation introduced completely different rules of VAT determination for customers of distance selling of goods.

In the following article, we will discuss the most important VAT issues in international e-commerce and online marketplaces. Do you still need to calculate the distance selling threshold? Does the use of the foreign warehouse require local VAT registration? You will find the answers below!

General rules of VAT taxation of B2C distance sales

As a rule, selling goods from businesses established in another country to private individuals shall be subject to VAT in the country of destination of goods.

Perhaps it sounds already so legally convoluted at the beginning that you ask yourself whether ... it's worth betting on selling abroad at all. As data collected by business.com shows, the online sales market is not equal to the same market from abroad. The portal indicates that currently the following markets can be counted among the largest players in the industry with values amounting to:

- China: $672 billion

- USA: $340 billion

- United Kingdom: $99 billion

- Japan: $79 billion

- Germany: $73 billion

- France: $43 billion

- South Korea: $37 billion

- Canada: $30 billion

- Russia: $20 billion

- Brazil: $19 billion

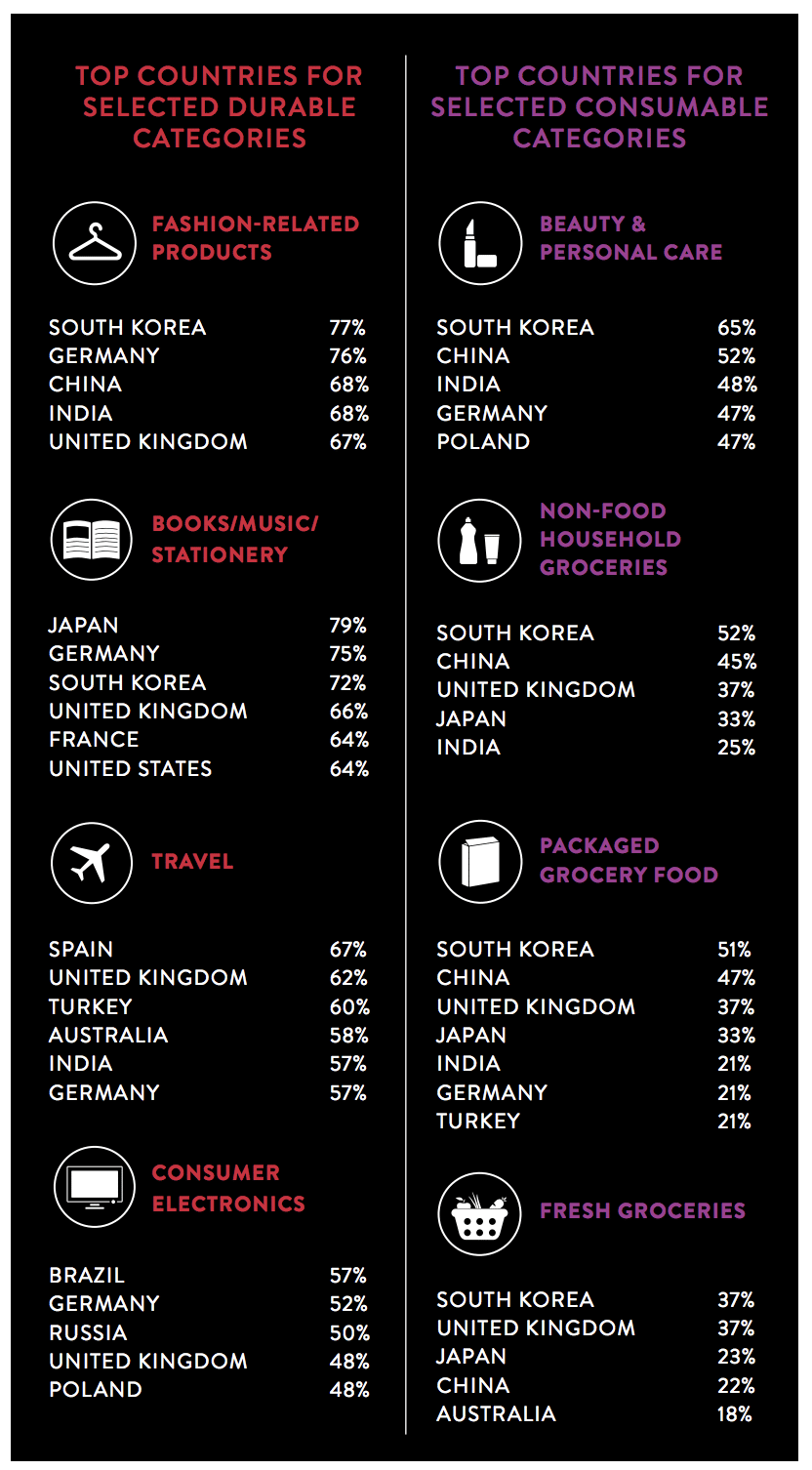

Other factors complicate the matter of running an efficient online marketplace, including the type of goods you offer your customers. Take a look at the graphic from Nielsen's Global Connected Commerce report - and see for yourself which boundaries are worth redirecting sales forces in your industry:

The game of becoming one of the overseas sellers is therefore definitely worth the proverbial candle. You can apply the local VAT in the country of dispatch of goods only if your yearly turnover doesn’t exceed the threshold of EUR 10.000.

How should the threshold be calculated? Let’s assume that a company operates in Poland and sells goods to individual customers in Germany – EUR 6.000 yearly – and in France – EUR 7.000 yearly.

In the given example, the threshold should be deemed as exceeded. When calculating the threshold, you should sum up the value of sales to all EU countries (not to a single one).

Once the distant sale threshold is exceeded the supplier should, as a rule, be registered for VAT in each EU country of destination of goods. However, in order to mitigate the administrative and financial burdens, the EU countries decided to create a so-called one-stop-shop scheme (VAT-OSS).

The VAT-OSS scheme is voluntary and enables easy reconciliation of the VAT due in different EU countries. VAT-OSS is dedicated solely to supplies of goods to private individuals from other EU countries. When using the VAT-OSS scheme, you can submit one joint tax return for all EU countries. Also, the payment is made to your local tax office.

As a result, you don’t have to apply for any foreign VAT registration (provided that your warehouse is located in the country of your residence).

Distant sales to B2B clients from the EU

Selling goods to VAT payers in other EU member states is defined as an intra-community supply of goods. Such services are subject to a 0% VAT rate, provided that certain formal conditions are met (e.g. purchaser possesses a valid VAT EU ID). Simultaneously, the purchaser is obliged to report the intra-Community acquisition of goods in the country of destination of goods (the so-called vat reverse-charge mechanism is applicable).

As a consequence, the B2B sale is quite straightforward from the VAT perspective. In particular, as a seller of goods, you don’t need to be registered for VAT purposes in the country of destination of goods (provided that you don’t have any foreign warehouse). You just need to remember some formal procedures – such as registration as the VAT EU payer in the country of your residence and gathering proofs of goods transportation.

Foreign warehouse or fulfillment center in the service of international trade

Nowadays more and more sellers decide to set up a foreign warehouse. This move enables significantly shorten the delivery period in other EU countries and as a result, your company becomes even more competitive. On the other hand - distance sales generate the need to fill out transport documents and customs declarations.

.png?width=1280&name=storage%20(1).png)

If you store the goods in other EU countries, most probably you will fall into the scope of local VAT taxation.

Let’s consider the case of a German seller who possesses warehouses located in Poland and the Czech Republic.

This German seller will need to obtain a local VAT ID both in Poland and the Czech Republic. The VAT registration is needed to report:

- the movement of goods between foreign warehouses – such movement is treated as an intra-Community transaction for VAT purposes and requires the relevant reporting (EC sales lists).

- B2B sale to local and EU clients (in line with the rules described in the point above)

- local supply of goods (to Polish and Czech clients).

In particular, please note that local supplies cannot be covered by the VAT-OSS scheme as they do not constitute distance intra-community sales.

However, if the goods are shipped to other EU countries – for example, France or Austria, the seller is still entitled to register in a VAT-OSS scheme to report such transactions (in Germany – the country of its residence).

To sum up, the such seller might be obliged to submit:

- Local VAT return in the Czech Republic in Poland – to cover the local sale of goods;

- EC sales in the Czech Republic and Poland to cover EU B2B transactions (intra-community supply/acquisition of goods) as well as internal movements of goods between the warehouses;

- VAT-OSS return in Germany - to cover the B2C sale to other EU countries.

Summary

The e-commerce sale may result in different VAT reporting requirements. Depending on your logistic strategy, you may need to apply for local VAT ID, VAT EU or VAT OSS registration. Sometimes you may need all these actions combined.

Therefore, to mitigate the risk of disputes with the tax authorities, it is extremely important to carefully analyze your business model and any potential fiscal requirements.

As you can see above, using foreign warehouses means much more VAT reporting compared to standard goods dispatched from your own, local warehouse. However, there is nothing to worry about as long as you are properly prepared and have a reliable tax compliance partner. Taxology, our reliable partner, can provide you with such safety and comprehensive service. Don't be afraid of the financial crisis, new VAT rules, duty obligations, or customs rules - thanks to cooperation with us you will achieve business success abroad. Become a successive overseas seller right now!