In order to answer your request, we are obligated to process the data given above. Sometimes, however, we would like to use them for slightly different purposes, such as statistical data or informing you about our new products and services.We promise that we will use the given information for communication purposes only. We also remind you that you can unsubscribe from our mailing at any time (see Privacy Policy).

The recent 2-3 years have brought such a rampant development of online sales that even the big and stable eCommerce businesses struggled to keep up with the changes.

A question arises: what exactly happened and how deeply it influences online businesses and the entire environment? Is it only the COVID-19 pandemic? Or maybe the new ways of shopping that customers choose to follow? Or maybe too little understanding of customers' behaviour switching between various online and offline channels?

Each of these theories is partly true - in this article, I will however focus on reasons that allowed some online retailers to grow and achieve eCommerce success while others significantly shrunk.

Little hint: it is mainly about the eCommerce metrics that have been taken care of by the most successful e-businesses.

No measurement, no results

The eCommerce industry keeps growing. A few years back nobody would expect that the delivery market will be dominated by parcel lockers. Today, in Poland, you can see them all over the country - every other neighbourhood, village, and city has dozens of metal white, yellow, green, and red constructions that hold our valuables bought online.

It's similar when it comes to payment methods. Poles quickly realised how beneficial a deferred payment date could be. As a result, while shopping they don't tie up their own resources and decide to eventually repay the debt or return the order.

Discretion improves customer satisfaction.

I could go on with such cases but I'd rather elaborate on how to cope with the inevitable changes and the unpredictability. At some point, Google Analytics connected with the store reporting tool was enough to draw meaningful conclusions and assess the online store's performance. It's not anymore. Some may say that they additionally correlate the numbers with the ERP and bookkeeping systems but I shall respond "Let's look into this!" In today's post we will examine the eCommerce key performance indicators.

What to measure: Customer Acquisition Cost (CAC)

When we talk about CAC with my clients, the majority of them say: "It's easy! You just need to subtract the Cost Per Click (CPC) value from the margin and there it is - unitary Customer Acquisition Cost." Neither theoretically nor practically is this true.

Diving into this: what about a client who visited the website 20 times before making a purchase and each visit started with a Google or Facebook ad click? What if his decision timeframe was not 5-minute long but took 5 months? Do you know the shopping cart abandonment rate for that customer? How many of you make advanced cohort eCommerce website analyses while counting the CAC thus collecting real-life data about the actual decision time and what was its cost?

.png?width=1200&name=ecommerce-kpi%20(1).png)

What to measure: sales margin

Again, it seems like an easy question with a straightforward answer:

Price - purchase cost - Customer Acquisition Cost (CAC) - delivery cost - packaging cost - order management cost = margin

Unfortunately, it is not that simple. What if you looked at the margin from a cash flow perspective? What if the product that the client bought has spent 6 months or more on the storage shelf? In this scenario, the equation should include:

- frozen cash cost

- time from the moment of purchase to delivery

If you add to it even the lowest possible bank interest, you will have a few more elements that lower the product margin - it then illustrates the real value of the transaction. To make it even more complicated, let's add one more variable - return rates. If the client returns the product, the real margin shrinks.

Only after considering the above elements, will you know what the profit is and how much money, if any, you have left for investments. If you are not sure how to measure your business metrics, drop us an e-mail and check what we can achieve together.

.png?width=1200&name=sales-margin%20(1).png)

What to measure: Customer lifetime value (CLV)

Customer lifetime value is an eCommerce KPI (key performance indicator) that shows whether our customers are attached to our brand or treat our online store only as a place to address their one-time needs. The biggest Polish marketplace has a huge board in the Data Analytics Department that tracks customer return time for specific product categories. This allows them to calculate what the average order value of one customer is and whether they lose on one-time transactions in the long run or not.

Calculating the real customer lifetime value allows you to assess if they bring profit to your eCommerce business. Let's imagine you sell eco cosmetics produced by well-known brands and your clients buy them from time to time. When you know how often they make purchases you can then ask them at the right moment if they need the next delivery. If you do not send reminders and each time they use Google search and click on ads to make an order then you pay again for winning them over.

Customer loyalty is something you should be especially committed to. Even if sometimes it's very fragile and fickle.

There are many examples like this. Competition is fierce in every industry thus getting to know your customers, their needs and approximate value will help you decide which clients are worth your attention.

What to measure: Competition analysis

2021 showed us why analysing competitors is so important. When the crucial supply chains got stuck - freights were delayed by weeks or even months. This situation influenced the cash flow - "I have nothing to sell, as I run out of stock, so my eCommerce cannot fulfill its main task - selling".

Are you able to avoid such situations? It seems impossible, however, the market operates no matter what - the bigger online retailers, anticipating certain problems, stalled the products in the warehouse only to sell them later with a higher margin.

Data analysis makes you switched on about the market situation and competitors and - as in the above example - able to alter the order completion time. If we analyze the competition not only by taking into account prices but also other eCommerce KPIs such as order completion time, we can easily realise when the competitors lack stock and use this opportunity to evaluate your prices and conditions.

It was visible in the construction industry, where the gas furnaces were unavailable for more than 6 months in 2021. Some prudent merchants offered them for more than 40% of their price a few months back. Its purchase cost didn't change - the sellers waited and properly assessed the economic situation and sold the lacking products with a higher margin reaching new customers and... business goals.

.png?width=1200&name=competition-analyst%20(1).png)

What to measure: Warehouse analysis

Figure out what stock has been in the warehouse for more than 30 days, and if you have such goods, use the promotion to get rid of them as sooner or later they will cause loss. If you are surprised by such an approach consider these few elements:

- stock that occupies the warehouse and could be replaced with goods that actually rotate

- every day at the warehouse is a loss - unstable currency rates make it even bigger, as the purchase cost raises

- excess stock lowers the product margin

- if you have a warehouse full of stock - it means that you made some mistakes along the way (customers analysis, purchasing potential, etc.) - take a moment and wonder why

In terms of warehouse analysis, you should consider whether you run an appropriate purchasing policy. Your decisions directly influence the balance sheet.

Have you ever checked what products your clients buy the most often? For example: let's say you have 4 000 product indexes in your warehouse. 200 of them rotate regularly but are being bought by 5 clients. If only one of them decides not to buy the products, you will lose 1/5 of your entire turnover.

What else should you measure in eCommerce store?

I have been advising companies on online sales for more than 8 years. "Buy cheap, sell expensive - that's what matters" is an attitude I have come across way too often. eCommerce is definitely more complex than that. What the pandemics showed us - if you leave out proper data analysis, the consequences will hunt you down anyway.

Changing taxes and new law regulations trigger business owners to consult tax advisors and choose the best solutions for their companies. At the same time, how many online store managers decided to choose the best strategy when it comes to sales key performance indicators? Each year eCommerce sales become more and more complicated. New internal and external factors influence its margin and the company's profits in general.

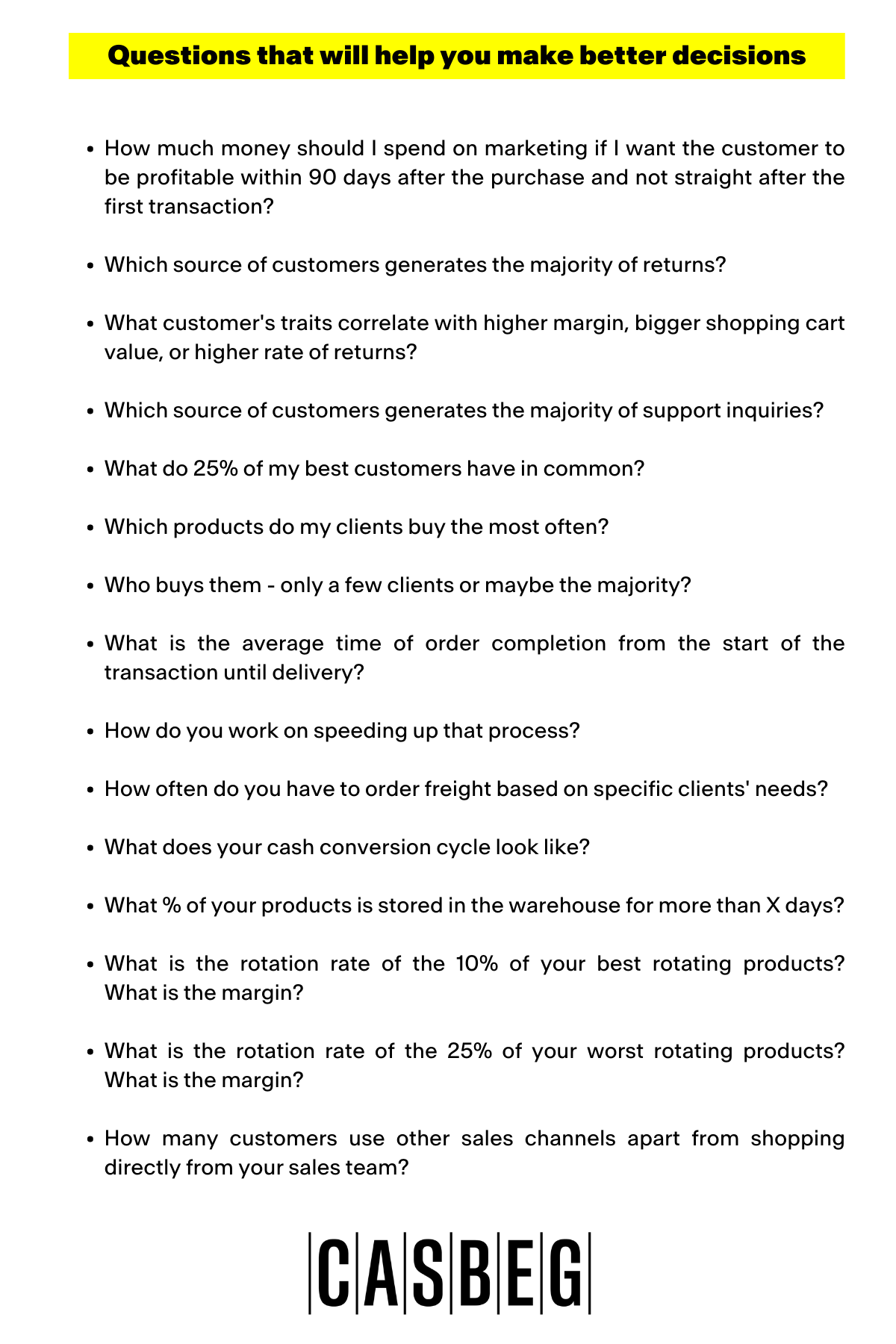

Dear Reader, can you answer these questions based on the data and facts of your online business without using your intuition?

If yes, then I truly congratulate you on your business background. If not, start working on them as soon as possible before the competition gets ahead.